During a business’ critical early days, the owners are naturally focussed on sales and operations, rather than say corporate governance or structuring. As a result, the business’ assets often end up being scattered across many different and sometimes unrelated entities.

For so long as the business is operated by the owner, this asset dispersal makes little difference. However, it can become critical if the owners decide to sell out and move on. Once a sales process starts, potential purchasers will have one overriding question: Am I actually buying all of the assets that the business needs to operate?

Where the business’ owner (vendor) is not able to answer this question satisfactorily, this will almost always lead to delay in the sale process and related time and cost overruns. In extreme cases an ‘unready for sale’ business can lead to the process being abandoned altogether.

To overcome this issue, we recommend potential vendors undertake Vendor Due Diligence (VDD) before starting the sale process. Some of the purposes of VDD are to:

- identify what assets are used in the business;

- determine whether any of these assets are not owned or controlled by the vendor/target business;

- ascertain if the vendor/target business holds any liabilities that do not relate to the business being sold; and

- ultimately, give the purchaser confidence that the business is ‘sale ready’.

It is common for a VDD process to be accompanied by a pre-sale restructure. This can involve moving key assets into the target business and addressing unrelated liabilities.

VDD and a pre-sale restructure can make a sales process significantly faster and more efficient. As above, some of the benefits of this process include:

- increasing the attractiveness of the business to buyers (‘buyer friendly’), as well as enhancing the credibility of the sale process;

- reducing the negotiation time with the preferred bidder; and

- simplifying the transaction structure and documentation, hence reducing transaction costs.

Context for VDD

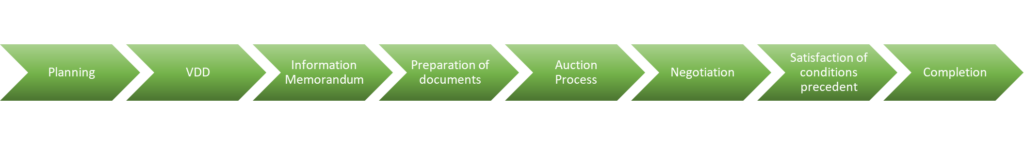

Below is an outline of the various steps typically involved in an ‘auction style’ business sale transaction. This paper focusses on the second of those steps, VDD and pre-sale restructures. Please refer to our separate publications for discussion of the other steps.

The alternative to VDD | Complexity, delay and frustration

Vendors who commence a sales process without VDD, commonly experience delays and increased costs in the transaction stage. These delays commonly lead to protracted negotiations, resulting in:

- more complex and usually conditional (uncertain) transaction documentation; For example, a sale and purchase agreement that is conditional on due diligence being completed; and

- greater cost and delays for both parties. In some cases, this can lead to mutual frustration between the parties, which is very destabilising to the sales process.

Undertaking VDD | Content and common issues

Some of the common issues disclosed by a VDD process are outlined below:

Key tangible assets not owned by the vendor or target business or are encumbered

It may be that the business’ premises, plant or equipment are owned by a third party. It is relatively common for an affiliate of the vendor (such as a family trust) to own real estate/premises that may be leased to the business often at concessional rates.

Alternatively, these assets may be encumbered by security interests held by third parties such as financiers or lenders. This is particularly relevant for more traditional bricks and mortar businesses rather than, say, IT or technology enterprises.

Intellectual Property

Many modern businesses rely extensively on intangible assets such intellectual property, for example copyright, knowhow, patents or the like. As a general rule, intellectual property rights vest in their creator unless created in the course of that person’s employment, in which case they vest in the employer.

However, if intellectual property rights are created by a third person (such as a founder) before the target business was established (or, in some cases afterwards), they may still be owned by the creator.

Identifying the person who owns these intellectual property rights can be vital where the owner is not the vendor/target business.

Systems & IT

A related issue is the rights of use of key systems and platforms. Again, it is fairly common for the rights in proprietary systems to be owned outside the vendor/target business for example by an affiliate. The rights of use in licensed systems can also be held by a third party.

Employees

It is relatively common to find the employees of the target business are employed by another company or trust. The employer company may be part of the same group as the target business, or separate to it (but typically under common control).

Takeaways

In our experience, the great majority of business sale transactions will benefit from a thorough VDD and pre-sale restructuring process. The savings in time and cost will nearly always far out-weigh the cost associated with this process.

In some cases, the purchaser may not require all these assets. For example, the purchaser may be a large corporate group with its own premises and systems. In these cases, it is common for the vendor and purchaser to execute a Transitional Services Agreement (TSA). A TSA will typically provide for the Vendor (or an affiliate) to provide access to the assets or systems for a short-term period, say three to six months. Often such access is typically provided on a best-efforts basis and without arm’s length warranties or service levels. In this way, the Purchaser can then migrate the business to its own systems during the transitional period, allowing for a smooth transition over a period of time.

This article is for general information purposes only and does not constitute legal or professional advice. It should not be used as a substitute for legal advice relating to your particular circumstances. Please also note that the law may have changed since the date of this article.